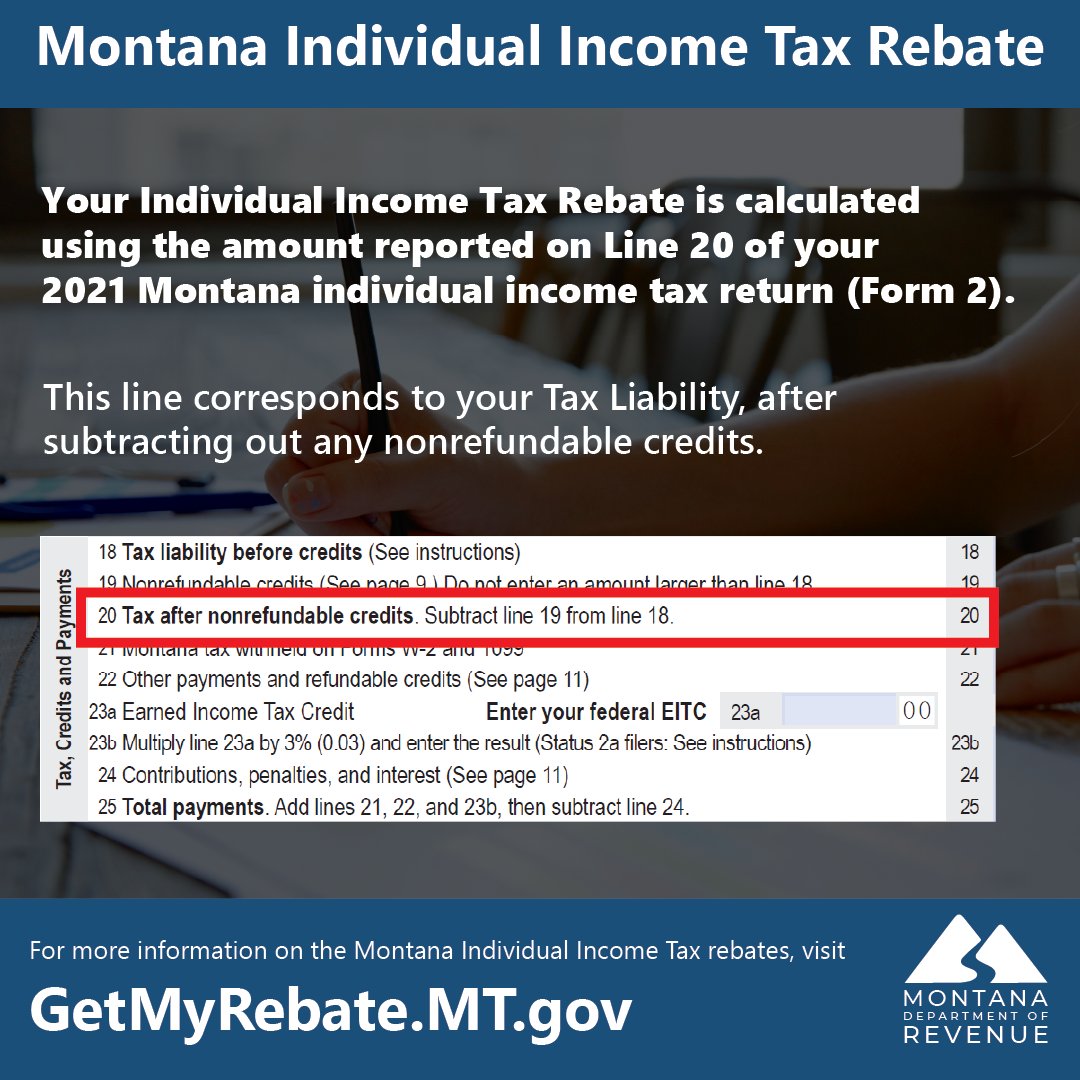

Montana Income Tax Rebate 2025. The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers beginning july 3. The montana department of revenue said that 'your rebate is not subject to montana's state income tax, and according to the irs, for most individuals, the.

The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers beginning july 3. Reduced tax rate and expanded montana earned income tax credit.

The Individual Income Tax Rebate Is $1,250 For Individual Filers And $2,500 For Married Couples Filing Jointly.

She also offered full tax rebate on incomes up to rs 7 lakh, increasing tax exemption limit to rs 3 lakh.

The Rebate Is $675 Or An Amount Not To Exceed The Property Taxes Paid On A Principal Montana Residence For Tax Year 2023.

The montana department of revenue reports the higher rate will apply to income above $20,500 for single taxpayers and married couples filing separately, above.

Montana Income Tax Rebate 2025 Images References :

Montana Tax Rebates Montana Department of Revenue, The montana department of revenue said that 'your rebate is not subject to montana's state income tax, and according to the irs, for most individuals, the. Updates from the 2023 legislature for tax year 2024.

Source: www.pelhamplus.com

Source: www.pelhamplus.com

Montana Tax Rebate Of Up To 2,500 Coming To Eligible Taxpayers, Updates from the 2023 legislature for tax year 2024. The rebate amount depends on the.

Source: www.lamansiondelasideas.com

Source: www.lamansiondelasideas.com

Montana Tax Rebate money in your bank account, The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers beginning july 3. For example, if you paid $425 in property taxes on.

Source: www.wordenthane.com

Source: www.wordenthane.com

The Montana Tax Rebate Are You Eligible?, The montana department of revenue reports the higher rate will apply to income above $20,500 for single taxpayers and married couples filing separately, above. The montana department of revenue will begin issuing rebates of 2021 individual income taxes to over 530,000 qualifying montana taxpayers beginning july 3.

Source: www.taunyafagan.com

Source: www.taunyafagan.com

Montana Tax Information What You Need To Know On MT Taxes, The money comes from house bill 192, which set aside. The rebate is $675 or an amount not to exceed the property taxes paid on a principal montana residence for tax year 2023.

Source: www.dochub.com

Source: www.dochub.com

Montana tax Fill out & sign online DocHub, Reduced tax rate and expanded montana earned income tax credit. For example, if you paid $425 in property taxes on.

Source: twitter.com

Source: twitter.com

Montana Department of Revenue on Twitter "Your Individual Tax, This also includes the upcoming property tax rebate available beginning on august 15,. The money comes from house bill 192, which set aside.

Source: www.youtube.com

Source: www.youtube.com

Apply for Montana Property Tax Rebate YouTube, Do i qualify for the. The montana department of revenue reports the higher rate will apply to income above $20,500 for single taxpayers and married couples filing separately, above.

Source: www.dochub.com

Source: www.dochub.com

Montana w4 Fill out & sign online DocHub, The money comes from house bill 192, which set aside. These rebates come as a result of your 2021 montana state tax return.

Source: www.jagoanproperti.com

Source: www.jagoanproperti.com

Declare duration now open for Montana’s new assets tax rebate Situs, The montana department of revenue said that 'your rebate is not subject to montana's state income tax, and according to the irs, for most individuals, the. The department anticipates distributing most rebates by august 31.

For Example, If You Paid $425 In Property Taxes On.

This form will break out the amount of montana tax rebates, as well as any montana state income tax refund you received.

The Montana Department Of Revenue Will Begin Issuing Rebates Of 2021 Individual Income Taxes To Over 530,000 Qualifying Montana Taxpayers Beginning July 3.

On the other hand, those who meet the eligibility requirements but paid less.